As the old song goes, “Christmas is coming” – and after the family get-togethers, then comes the summer break. If you’re an employee taking your annual leave, that’s fine.

However, if you’re an SME operator then what follows Christmas – all too often – is a summer cash flow drought. It’s a period that is becoming more like hiking through Death Valley every year.

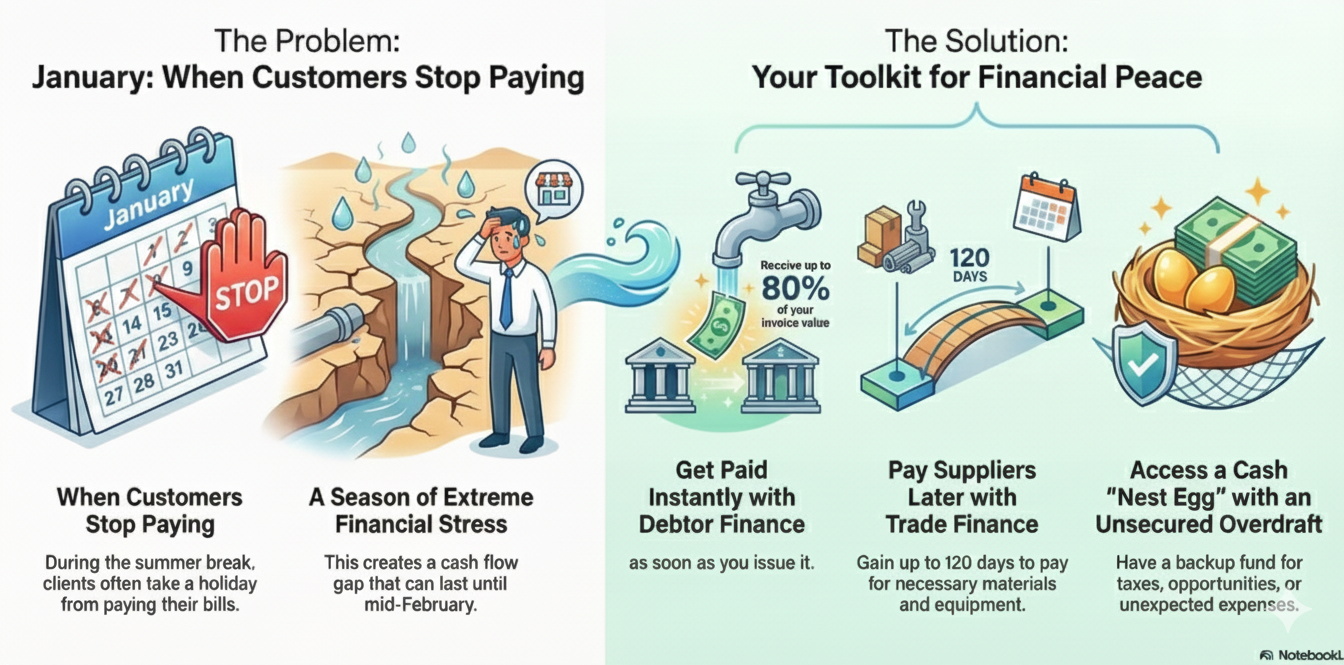

January is when a lot of your customers will take a break – including a break from paying their bills. What that means is that every year, you get a “gift” of extreme cash flow stress that could well last to the middle of February.

Imagine if you could change that drought into a gentle, soaking flow of cash…

There IS a way to avoid the summer cash flow drought

Imagine if you could get paid immediately….

Imagine if – every time you invoiced a customer – you got paid 80% of that invoice value immediately. Not “after Christmas”. Not “when my bookkeeper gets back from holiday”. Immediately!

What would being paid early free you up to do in January? Actually, do some planning? Relax? Sleep at night? Or even (whisper it quietly) take a holiday yourself?

It doesn’t have to be a dream anymore….

This is the functionality – and cash flow – that today’s affordable, integrated Debtor Finance tools deliver to small business operators. Integrated finance tools that grow with your business, without ongoing time-consuming application and approval overheads.

Imagine if your suppliers gave you 120-day credit terms…

Imagine if – every time you placed an order with your suppliers – you got 120 days to pay them.

Imagine that you could buy the materials and equipment you need to get customer jobs finished efficiently – without a constant balancing act to manage payroll and BAS payments and still purchase critical supplies.

How would you operate over January if you didn’t have to pay for inputs months before you got paid?

This doesn’t have to be a dream, either – it’s what today’s integrated, tech-enabled Trade Finance tools offer SME operators today.

Imagine if you had an extra pot of money….

Imagine if you had a secure nest egg of extra cash tucked away – a resource that you could draw on to help with one-off expenses and opportunities.

What could you do with an extra $10,000 or so? Pay off a looming tax debt? Keep up with your staff super obligations easily? Buy desperately needed tools and equipment?

This doesn’t have to be a dream…

It’s the functionality – and backup cash – that today’s balance-sheet-secured Unsecured Overdrafts deliver to small business operators today.

Give yourself the gift of Cash Flow Peace this year

The same technology that has delivered smartphones, QuickBooks, Xero and social media has also delivered a toolkit of integrated, affordable business financing solutions designed specifically for small businesses.

It’s technology that is increasingly necessary in a world where big businesses demand long 30/60/90 day credit terms from their suppliers.

There’s still time to give yourself this gift THIS year – if you’re quick!

Typical approval timelines for today’s top SME financing tools are measured in days, not weeks and months. That means that – if you act quickly – you can give yourself a vacation from financial worries this festive season.